-

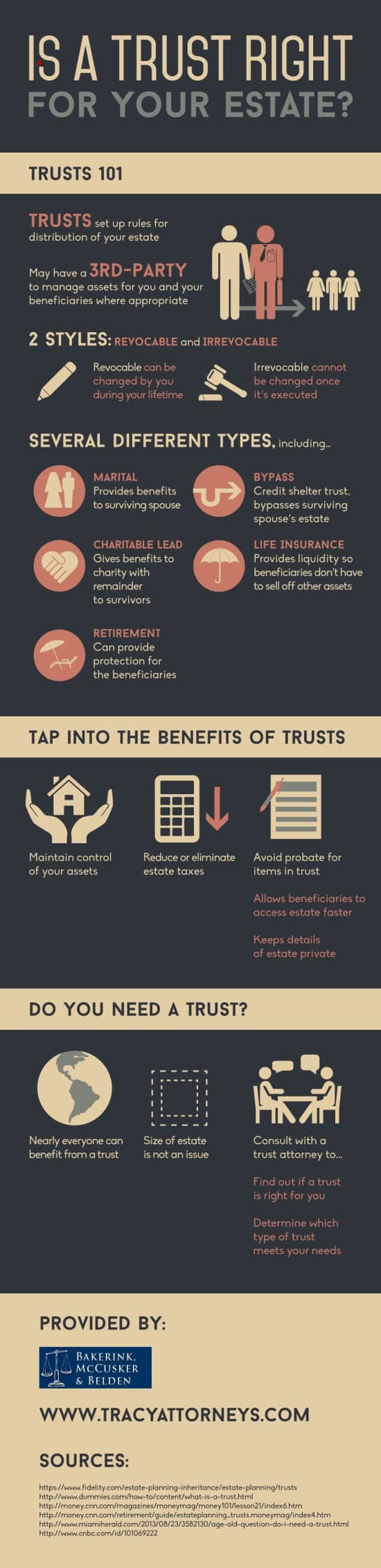

Is a Trust Right for Your Estate? [INFOGRAPHIC]

When estate planning, most people mistakenly believe that trusts are reserved exclusively for the wealthy. In fact, nearly anyone can benefit from setting up a trust. A trust simply gives you control over how your assets are distributed after you pass. In addition to giving you that extra control, trusts can help your beneficiaries avoid estate taxes and probate proceedings. In this infographic from Bakerink, McCusker & Belden Law , attorneys offering estate planning in Tracy, you’ll learn how trusts work and who can benefit from them. To find out which kind of trust is right for you, contact one of our lawyers. You can also arm your family and friends with the knowledge they need for estate planning by sharing this information with them.

-

Attorney Spotlight: Brinton R. McCusker

Brinton R. McCusker, a lawyer serving Tracy , has been providing legal guidance to California residents since 1997. As a founding partner of Bakerink, McCusker & Belden, this injury lawyer has helped hundreds of clients reach favorable resolutions of their cases. Mr. McCusker has extensive experience with all types of personal injury cases, including auto accidents, motorcycle crashes, truck accidents, dog bites, slip and falls, and defective products. Mr. McCusker also represents property managers and landlords in eviction cases, along with civil litigation involving real property disputes and breach of contract.

Before Mr. McCusker began serving residents of Tracy and nearby areas as a skilled lawyer, he served his country in the U.S. Army from 1985 to 1989 as a Russian linguist. Later, in law school, he worked as a law clerk for the County of San Joaquin. Upon becoming a lawyer admitted to the State Bar of California, Mr. McCusker also became a member of the Consumer Attorneys of California, an organization dedicated to fighting for justice on behalf of those who have suffered losses due to negligent acts.

Before Mr. McCusker began serving residents of Tracy and nearby areas as a skilled lawyer, he served his country in the U.S. Army from 1985 to 1989 as a Russian linguist. Later, in law school, he worked as a law clerk for the County of San Joaquin. Upon becoming a lawyer admitted to the State Bar of California, Mr. McCusker also became a member of the Consumer Attorneys of California, an organization dedicated to fighting for justice on behalf of those who have suffered losses due to negligent acts. -

The Importance of Legal Help after an Accident

If you have been injured in an accident, it’s essential that you take immediate action to protect yourself and your rights. One of your first steps should be to contact a personal injury lawyer near Tracy to set up a consultation. During that initial meeting, your attorney can help you determine whether you have a case and who should be held responsible for the harm you have suffered. Your attorney can also inform you of how much compensation you may be entitled to for your injuries, which will help you decide whether your case is worth pursuing. Bringing a legal case can be a complex process, and a seasoned attorney will have the expertise and knowledge of California law that is necessary to navigate the legal system and bring your case to a satisfactory conclusion. No matter what kind of accident you have been involved in, an experienced accident attorney can help you.

If you have been injured in an accident, it’s essential that you take immediate action to protect yourself and your rights. One of your first steps should be to contact a personal injury lawyer near Tracy to set up a consultation. During that initial meeting, your attorney can help you determine whether you have a case and who should be held responsible for the harm you have suffered. Your attorney can also inform you of how much compensation you may be entitled to for your injuries, which will help you decide whether your case is worth pursuing. Bringing a legal case can be a complex process, and a seasoned attorney will have the expertise and knowledge of California law that is necessary to navigate the legal system and bring your case to a satisfactory conclusion. No matter what kind of accident you have been involved in, an experienced accident attorney can help you. -

Important Information About Wrongful Death

In a perfect world, no one would be killed as a result of another’s recklessness or negligence. However, thousands of people die every year as a direct result of unsafe conditions and wrongful actions. Though nothing can be done to bring these people back, their dependents can seek financial compensation. If you believe that your deceased loved one’s death was caused by negligence, consider having a Tracy personal injury lawyer at Bakerink, McCusker & Belden to help you file a wrongful death claim.

In a perfect world, no one would be killed as a result of another’s recklessness or negligence. However, thousands of people die every year as a direct result of unsafe conditions and wrongful actions. Though nothing can be done to bring these people back, their dependents can seek financial compensation. If you believe that your deceased loved one’s death was caused by negligence, consider having a Tracy personal injury lawyer at Bakerink, McCusker & Belden to help you file a wrongful death claim.There are a number of negligence-related circumstances that might result in a person’s death. For example, an individual might be killed during an accident with a drunk driver, or an irresponsible medical professional may fail to diagnose a well-known fatal disease while it’s still treatable. Whatever the cause of the person’s death, the victim’s family may choose to hold the guilty party accountable by filing a wrongful death claim. The family might demand compensation for the loss of income, funeral expenses, and emotional distress they incurred in the wake of their loved one’s wrongful death.

-

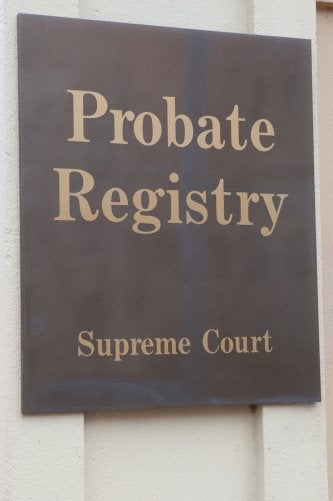

Understanding the Probate Process

Probate is the process of sorting through the assets of a deceased individual and passing them on to inheritors and creditors. Probate is supervised by a court. It can be a lengthy, complicated process, and many individuals who are chosen as executors feel overwhelmed by the idea of handling these affairs. If you have been named an executor, contact a lawyer with Bakerink, McCusker & Belden right away to discuss probate and your responsibilities. The first step your attorney will take is to arrange for the court to officially designate you as the executor.

Probate is the process of sorting through the assets of a deceased individual and passing them on to inheritors and creditors. Probate is supervised by a court. It can be a lengthy, complicated process, and many individuals who are chosen as executors feel overwhelmed by the idea of handling these affairs. If you have been named an executor, contact a lawyer with Bakerink, McCusker & Belden right away to discuss probate and your responsibilities. The first step your attorney will take is to arrange for the court to officially designate you as the executor. Once you are officially designated as the executor, you have a number of tasks ahead of you. As your lawyer in Tracy with Bakerink, McCusker & Belden can explain to you, you’ll need to file the original will, death certificate, and petition for probate in the court. You’ll need to publish a notice of probate and mail notices to all known creditors, along with the beneficiaries and heirs. Then, the court will require you to file proof that you did indeed fulfill those responsibilities. Your lawyer with Bakerink, McCusker & Belden will walk you through handling other responsibilities, including dealing with taxes, resolving debts, and distributing remaining assets.

-

An Overview of the Steps of Planning a Will

It’s all too common to delay creating a will until a serious illness strikes or an individual celebrates a milestone birthday. Many people delay consulting a lawyer regarding estate planning because they expect to lead a long, healthy life. While this is certainly ideal, a catastrophe can strike at any time. It’s advisable for all adults to work with Bakerink, McCusker & Belden a lawyer in Tracy to create a will. By establishing a last will and testament, you can protect your family’s future.

Evaluating Your Assets

Before you sit down with your lawyer to write your will, make a list of all of your assets. This list should include your bank accounts, real estate, retirement funds, life insurance policies, and various investments. It should also include personal assets such as your vehicle, art collections, jewelry, and other items of significant financial or sentimental value.

Designating Beneficiaries

Designating Beneficiaries Once you have a complete list of all of your assets, it’s time to decide who your beneficiaries will be . You can designate as few or as many beneficiaries as you wish. You may bequeath your liquid assets to your children, for example, and your real estate to your spouse. You may wish to divvy up family heirlooms among your beneficiaries. Bear in mind, however, that certain assets cannot be distributed with a will. This includes any property that you hold jointly. By law, this property will pass to the surviving owner. For example, if you own a house with your spouse, your spouse will automatically receive full ownership of the house upon your death.

Designating Legal Guardians

It’s widely known that wills are used to bequeath assets; however, many people overlook another important aspect of a will: Designating legal guardians. If you have children under the age of 18, you can use your will to designate a legal guardian upon your death. It’s common to designate a spouse as legal guardian and to designate another family member, such as a sibling, as the secondary guardian in the event that your spouse does not survive.

-

Tips for Setting Up a Living Trust

To protect your assets and your family’s financial future, you may wish to speak with a lawyer with Bakerink, McCusker & Belden who specializes in estate planning. A lawyer in Tracy with Bakerink, McCusker & Belden can help you establish a living trust. A living trust is much more than a document. It’s a funded entity. With the help of your living trust attorney, you will need to transfer your assets to the trust . Since you can serve as the trustee of your own trust, you will maintain full control over your assets.

As you’ll learn by watching this video, you should consider transferring assets such as bank accounts, stocks, bonds, securities, and other investments to the trust. However, for tax reasons, it’s usually best to avoid transferring annuities or IRAs to a living trust.

-

Common Questions About Living Trusts

A lawyer in Tracy with Bakerink, McCusker & Belden who specializes in estate planning can help you create a living trust. A living trust, which is a written document, essentially takes ownership of any assets that you transfer to it. It will be administered according to your wishes during your lifetime. Then, upon your death, its remaining assets will be distributed to the beneficiaries you designate. If you’re wondering whether creating this type of entity may be a wise financial decision for your particular needs, it’s advisable to contact a living trust attorney. Your lawyer can answer any questions you have about living trusts.

Why Should I Have a Living Trust?

Unlike a will, which is important for every adult to have, a living trust isn’t right for everyone. For example, if you’re a young adult, you do not have children, and you wish to leave all of your assets to your spouse in the event of your death, then you do not need a living trust. However, if you do have significant assets and you wish to bypass court supervision for the distribution of your assets, you should talk to a lawyer with Bakerink, McCusker & Belden about setting up this entity. A living trust can offer you multiple benefits. Since it’s created while you’re alive, it will be managed in accordance with your wishes. This remains true even in the event that you become incapacitated. If this occurs, a trustee you select will administer the trust according to your wishes. Upon your death, the trustee will pay any debts and taxes, and distribute the remaining assets to your heirs.

Who Is the Trustee?

Who Is the Trustee? It’s common for individuals to serve as the trustees of their own living trusts while they are living and capable of carrying out these fuctions. However, you may wish to select another person to fulfill this function if you prefer not to manage your everyday financial affairs. You could choose a family member or a professional fiduciary to be the trustee.

How Do I Transfer Assets?

Your lawyer with Bakerink, McCusker & Belden will help you transfer assets to the trust . The lawyer will need to prepare and record deeds to your real estate. The law firm of Bakerink, McCusker & Belden will also assist to transfer assets such as bank accounts, bond accounts, and certificates to the trust.

-

Tips for Leaving an Inheritance for Your Kids

When you’re ready to start thinking about your legacy to your children, it’s time to consult an estate planning lawyer . Your lawyer will draw up the documents for you and answer any questions you may have about estate planning in Tracy. For example, some parents automatically name the eldest child as the sole beneficiary of assets, after the death of a surviving spouse. They may assume that the eldest child will then fairly divide the assets among his or her siblings. However, to avoid confusion and ill will, it’s best to clearly state which child or other relative will receive which asset.

When you’re ready to start thinking about your legacy to your children, it’s time to consult an estate planning lawyer . Your lawyer will draw up the documents for you and answer any questions you may have about estate planning in Tracy. For example, some parents automatically name the eldest child as the sole beneficiary of assets, after the death of a surviving spouse. They may assume that the eldest child will then fairly divide the assets among his or her siblings. However, to avoid confusion and ill will, it’s best to clearly state which child or other relative will receive which asset.While handling matters of your estate, your lawyer may ask you if there are any stipulations involved with your kids’ inheritance. For example, it is possible to arrange for the inheritance to be distributed in installment payments when your kids reach certain ages. This can help prevent poor financial decision making. Estate planning lawyers often recommend these stipulations when children are known to have substance abuse issues or similar problems.

-

Essential Steps to Take Following a Car Accident

Each day, personal injury lawyers assist countless people who have been involved in car accidents. If you have been involved in an auto accident, no matter how minor, it’s important to follow a few general guidelines to protect yourself from legal liability. First, you must remain on the scene, even if it’s just a fender bender. Next, call the police and if necessary, call for an ambulance. Your injury lawyer serving Tracy will also advise you to get the name and insurance information of the other driver, in addition to the names of all passengers and witnesses.

Watch this video to learn what else you should do in the event of a car wreck. After calling for emergency responders, for example, it’s a good idea to call a lawyer. An injury lawyer can help you make sure that you have done everything necessary, such as taking photographs of the scene and documenting the circumstances of the crash.

RECENT POSTS

categories

- Uncategorized

- Personal Injury

- Estate Planning

- customer reviews

- Financial Planning

- Work Injury

- Tracy Lawyer

- Attorney

- Dog Bites

- Auto Accident

- Slip and Fall

- Car Accident

- Living Trusts

- Trust Administration

- Living Will

- Wrongful Death

- Probate

- advanced health care directive

- About Us

- Russian linguist

- Infographic

- Wills and Trusts

- Will

- Car Crash

- Executor

- Whiplash Injuries

- Estate Taxes

- Slip and Fall Injury

- Auto Accident Claims

- Intestate Succession

- Disinheritance

- Trust Administrators

- Cycle Accident

- Accident