-

Benefits of Charitable Giving Through a Living Trust

Before and After Death in Tracy, CA

What are Irrevocable Living Trusts?

Estate planning near Tracy and Livermore can involve much more than just a last will and testament. Your lawyer can also create a living trust for you, which helps you protect property and minimize the tax burden . A living trust is one that goes into effect during your lifetime, rather than only after your death. An irrevocable living trust is one that cannot be terminated. The majority of living trusts are revocable, which means that they can be terminated.

You can hear more about irrevocable living trusts by watching this video. This expert discusses some of the common types of irrevocable living trusts, such as charitable trusts. Charitable trusts facilitate gifts to charity while reducing income and estate taxes. There are many other different types of trusts; you can consult a lawyer who specializes in estate planning to learn more.

Common Questions About Charitable Giving After Death

Charitable giving after death is a gracious way to make a difference with your legacy. There are multiple ways to structure your postmortem giving, and some of them can be advantageous to your other beneficiaries, if applicable. A lawyer located in Tracy or Manteca can counsel you as to the most beneficial way to structure your estate plan to maximize charitable donations.

Can’t I just leave assets to a charity in my will?

Absolutely, you can, but it may be more advantageous to structure your giving differently. For instance, if you have appreciated assets, you could transfer them to a charitable remainder trust. If you would like to give to multiple charities, it may be best to create a private foundation. The manager of the foundation will make individual grants to various charities, individuals, or scholarships. One of the benefits of using an alternative means of distributing your assets, other than your will, is that your surviving family members can contest your will. If you’ve decided to disinherit your family, there may be an increased risk of a contested will.

Can charitable giving reduce my estate taxes?

Yes, if it’s done properly. Your estate planning attorney may recommend leaving your retirement assets to charities. These assets tend to be taxed the most after death. Structuring your giving so that your retirement assets are directly transferred to the charity will give your estate a federal estate tax charitable deduction. This lessens estate taxes for your beneficiaries. Plus, the charity won’t be required to pay taxes on your gift.

Can I donate my life insurance benefits to a charity?

Yes, you can. This is one of the simplest methods of charitable giving after death, and surviving family members cannot contest the transfer of assets. The money is paid directly to the charity, bypassing probate. However, there may be a better way to give your life insurance policy to your favorite cause. Look for a life insurance carrier with optional charitable giving riders. You can attach the rider to your policy, and after you die, the rider increases the face value of the benefits. Usually, attaching a rider doesn’t increase fees or premiums, although there may be maximum thresholds on the total gift amount.

-

What Is Probate?

After someone passes away in Tracy or Livermore, the probate process can begin. Probate is the process of filing a petition with the court to admit the will into probate or, in the absence of a will, appointing an estate administrator. When wills enter probate, they are publicly accessible. The decedent’s assets are inventoried and then the assets are transferred from the decedent to the heirs.

When you watch this video, you’ll hear a little more about probate and why some people might wish to avoid it. Since wills that enter into probate are publicly accessible, some people wish to avoid probate due to privacy concerns. It is also possible that the will may be contested. If you have any concerns about probate, a lawyer who handles estate planning cases can help you.

-

Guidance on Selecting the Right Trustee

If you have your lawyer establish a trust , then the trustee is responsible for administering the trust in accordance with your wishes after your death. In Tracy and Livermore, trust administration is a significant responsibility and often requires in-depth knowledge of estate planning matters. The trustee you choose can receive assistance from a law firm, but it’s still important to select a trustee who is capable of handling this responsibility.

Selecting a Family Member

It’s common to select a family member as a trustee or two select two family members to serve as co-trustees. If this is an option for you, then be sure to choose a family member who has solid business sense and good judgment. Your trustee should be expected to outlive you. Before settling on a relative, carefully consider whether family dynamics or family conflicts might interfere with the trustee’s ability to administer the trust in an appropriate manner. Even when a family trustee has the best of intentions at heart, he or she might be influenced to make an emotional decision. If you do decide to use a family trustee, make sure that person is willing to carry out these duties after your death.

Choosing a Professional Trustee

Many people choose a professional or corporate trustee. This option may be right for you if you do not have a family member whom you trust to faithfully administer the trust or if none of your relatives are willing to assume this role. Bear in mind that a corporate trustee will charge a fee, which might be a problem for trusts that are modestly funded. However, the advantage of choosing a corporate trustee is that he or she won’t be swayed by family dynamics or conflicts.

Authorizing a Relative and an Independent Advisor

It is possible to find a middle ground between choosing a family trustee versus a corporate trustee. You might decide to select a trustworthy family member to serve as a trustee, but then to also hire an independent investment advisor. This advisor could provide guidance to the trustee without charging the same high fee that would be typical of a corporate co-trustee.

-

Should You Consider Setting Up a Trust?

A trust is a financial arrangement that a lawyer can set up for you. While trusts can be very useful for many people, not everyone needs one. Generally, it’s advisable to have an estate planning attorney set up a trust on your behalf if you have substantial assets or complicated financial situations. For guidance on whether a trust can benefit your family, watch this video and contact an estate planning attorney near Tracy or Livermore.

The expert in this video discusses some of the types of trusts available and explains why some people may want to have a lawyer establish them. For example, upon your passing, any assets managed within your trust will bypass the probate process. This can help ease the transition of your passing for your surviving loved ones. Additionally, trusts may confer certain tax benefits.

-

Understanding Living Trusts

Life insurance policies are contracts that provide a lump sum payment to a named recipient upon an individual’s death. However, a life insurance policy can also be used to set up a trust near Tracy, which reduces or eliminates the federal estate tax owed on the money paid out of the life insurance policy.

This video explains how estate taxes affect life insurance proceeds and how a life insurance trust can be a valuable estate administration tool. The trust is used to pay the premiums of a life insurance contract; when the insured individual passes away, the proceeds are returned to the trust. Working with a trusted attorney during the estate planning process can help you determine if this type of trust is right for you and your family, as well as ensure your trust is compliant with all inheritance laws to minimize or even eliminate estate taxation.

-

Could You Benefit from a Living Trust?

You may already know that every adult should explore the basics of estate planning with an estate attorney near Tracy and Manteca. Although a last will and testament is often the first document that comes to mind when one is thinking about estate planning, a revocable living trust could be just as important. A living trust is a legal document that establishes control of any assets placed into the trust. For many people, setting up a living trust makes good sense for financial and practical purposes. Consider talking to a living trust attorney to find out if this arrangement could be right for you.

You may already know that every adult should explore the basics of estate planning with an estate attorney near Tracy and Manteca. Although a last will and testament is often the first document that comes to mind when one is thinking about estate planning, a revocable living trust could be just as important. A living trust is a legal document that establishes control of any assets placed into the trust. For many people, setting up a living trust makes good sense for financial and practical purposes. Consider talking to a living trust attorney to find out if this arrangement could be right for you.Would You Like to Retain Control of Your Assets?

A living trust may be appropriate for you if you’re looking for a way to plan for the future while currently maintaining control over your assets. When your attorneys establish a living trust, you are named the trustee. In other words, you aren’t forfeiting control of your assets just yet. In the event that you pass away or are declared incapacitated, control of the trust is transferred to the trustee whom you have designated.

Is Privacy Important to You?

When a decedent’s estate goes through probate, his or her financial affairs become a matter of public record. If you value your privacy, you can speak with an estate planning lawyer about creating a living trust, which will never become a publicly accessible record. This is an attribute of living trusts that may be particularly attractive to individuals with substantial wealth and those who are known to the public, such as elected officials.

Could Your Heirs Benefit from Avoiding Probate?

Many people consult a lawyer about establishing a living trust because they want their heirs to avoid the probate process upon their death. Probate can take months to finalize and in the meantime, heirs may need financial assets to take care of funeral costs and other expenses. When your successor trustee assumes control of the living trust upon your passing, he or she can distribute assets in a matter of weeks.

-

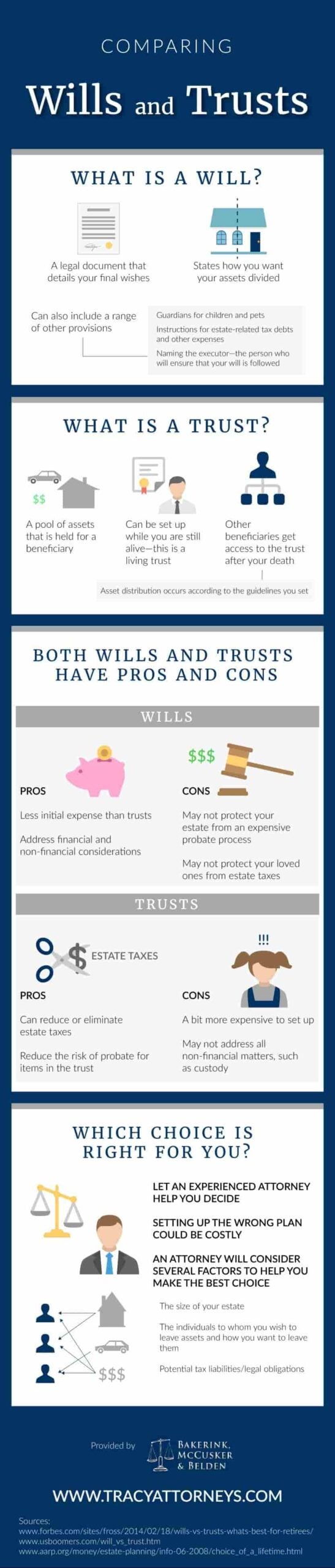

Comparing Wills and Trusts

Although making plans for your estate may be uncomfortable, it is one of the most important things you can do for your family. Two options you have are wills and trusts. Wills are legal documents that detail your final wishes, from who you wish to receive the assets in your estate to who should gain guardianship of your pets. Trusts can be set up while you’re alive and are a pool of assets that can be used by your beneficiaries. When you are alive, you are the beneficiary of your trust, and after your death, it will pass on to the people you have designated. Let one of the attorneys in Tracy at Bakerink, McCusker & Belden help you understand whether a will or trust is appropriate for your needs and help you set one up that adequately protects your family. Start a conversation with your family about estate planning by sharing this information.

-

Understanding the Basics of Estate Planning

Far too many people die intestate, which means they pass on without a will. When this happens, their assets are dealt with in accordance with state intestate succession laws. In some cases, when an heir cannot be identified, it is possible for the state to claim these assets. You can easily avoid these problems by consulting an estate planning lawyer in Tracy or Livermore. Your estate planning attorney will carefully review your finances, offer sound recommendations, and provide you with all the information you need to make wise decisions for your heirs.

Will

A last will and testament is a crucial document to have, regardless of your health or age. As your circumstances change, you may wish to visit your lawyer to have your will revised. For example, if you have more children or if grandchildren are born, you may wish to adjust your will to reflect your new inheritance preferences. Your lawyer will draft your will for you to ensure that your assets are distributed in accordance with your wishes after you pass on. Your will can be as detailed as you like. For example, some people simply prefer to leave all their assets to their spouse, while others prefer to designate heirs for specific items. You might leave a valuable jewelry collection to a granddaughter, for example, and leave a vehicle to a sibling. You can alsouse your will to leave gifts for your favorite charities. For parents and legal custodians, having a properly drafted will is particularly important. Your will can designate a guardian for any children who are still minors when you pass on. If you take care of someone who is mentally or physically incapacitated, you will also need to designate a guardian for that individual.

A last will and testament is a crucial document to have, regardless of your health or age. As your circumstances change, you may wish to visit your lawyer to have your will revised. For example, if you have more children or if grandchildren are born, you may wish to adjust your will to reflect your new inheritance preferences. Your lawyer will draft your will for you to ensure that your assets are distributed in accordance with your wishes after you pass on. Your will can be as detailed as you like. For example, some people simply prefer to leave all their assets to their spouse, while others prefer to designate heirs for specific items. You might leave a valuable jewelry collection to a granddaughter, for example, and leave a vehicle to a sibling. You can alsouse your will to leave gifts for your favorite charities. For parents and legal custodians, having a properly drafted will is particularly important. Your will can designate a guardian for any children who are still minors when you pass on. If you take care of someone who is mentally or physically incapacitated, you will also need to designate a guardian for that individual.Trust

Another basic component of estate planning is creating trusts. A living trust goes into effect during your lifetime, while a testamentary trust goes into effect after your death. You can transfer certain assets to a trust to protect them and reduce the tax burden. Trusts allow for the speedy distribution of assets to beneficiaries after a death. They may also place limitations on inheritances. -

Meet Attorney Michael C. Belden

At Bakerink, McCusker & Belden , our attorneys in Tracy are dedicated to providing our valued clientele with comprehensive legal guidance in our areas of specialization. Attorney Michael C. Belden, one of our partners, has extensive experience in the areas of estate planning, probate, trust administration, and bankruptcy. In 2014, the State Bar of California Board of Legal Specialization granted Mr. Belden the designation of Certified Specialist in Estate Planning, Trust, and Probate Law. The exhaustive certification process involved a number of continuing education programs, peer reviews, and an intensive examination.

Before Mr. Belden joined our law firm, he served as Assistant Banking Center Manager for Bank of America. He later reviewed appellate cases for the Civil Justice Association of California. Mr. Belden joined the law offices of Bakerink & McCusker as a law clerk in 2003, focusing on estate planning and related matters. He graduated from University of the Pacific, McGeorge School of Law in 2005 and was subsequently admitted to the California State Bar. Since joining our law offices, Mr. Belden has demonstrated an exemplary commitment to client education and counseling.

Before Mr. Belden joined our law firm, he served as Assistant Banking Center Manager for Bank of America. He later reviewed appellate cases for the Civil Justice Association of California. Mr. Belden joined the law offices of Bakerink & McCusker as a law clerk in 2003, focusing on estate planning and related matters. He graduated from University of the Pacific, McGeorge School of Law in 2005 and was subsequently admitted to the California State Bar. Since joining our law offices, Mr. Belden has demonstrated an exemplary commitment to client education and counseling. -

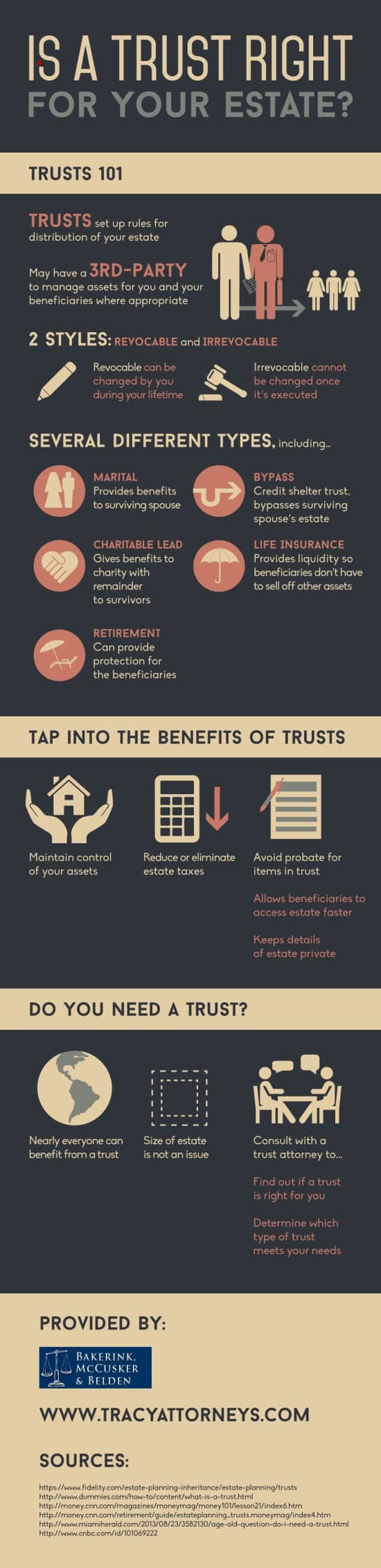

Is a Trust Right for Your Estate? [INFOGRAPHIC]

When estate planning, most people mistakenly believe that trusts are reserved exclusively for the wealthy. In fact, nearly anyone can benefit from setting up a trust. A trust simply gives you control over how your assets are distributed after you pass. In addition to giving you that extra control, trusts can help your beneficiaries avoid estate taxes and probate proceedings. In this infographic from Bakerink, McCusker & Belden Law , attorneys offering estate planning in Tracy, you’ll learn how trusts work and who can benefit from them. To find out which kind of trust is right for you, contact one of our lawyers. You can also arm your family and friends with the knowledge they need for estate planning by sharing this information with them.

RECENT POSTS

categories

- Uncategorized

- Personal Injury

- Estate Planning

- customer reviews

- Financial Planning

- Work Injury

- Tracy Lawyer

- Attorney

- Dog Bites

- Auto Accident

- Slip and Fall

- Car Accident

- Living Trusts

- Trust Administration

- Living Will

- Wrongful Death

- Probate

- advanced health care directive

- About Us

- Russian linguist

- Infographic

- Wills and Trusts

- Will

- Car Crash

- Executor

- Whiplash Injuries

- Estate Taxes

- Slip and Fall Injury

- Auto Accident Claims

- Intestate Succession

- Disinheritance

- Trust Administrators

- Cycle Accident

- Accident