-

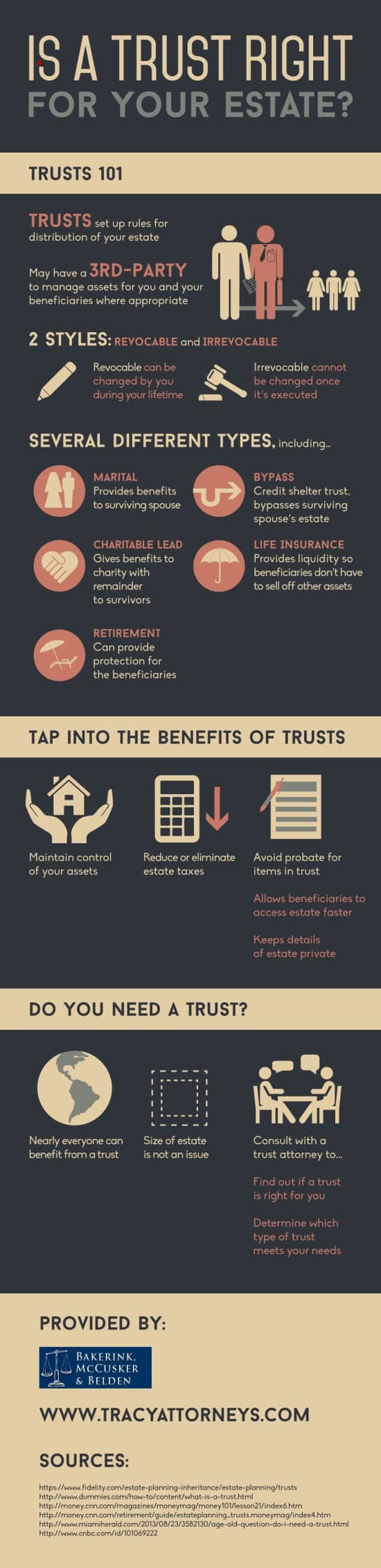

Is a Trust Right for Your Estate? [INFOGRAPHIC]

When estate planning, most people mistakenly believe that trusts are reserved exclusively for the wealthy. In fact, nearly anyone can benefit from setting up a trust. A trust simply gives you control over how your assets are distributed after you pass. In addition to giving you that extra control, trusts can help your beneficiaries avoid estate taxes and probate proceedings. In this infographic from Bakerink, McCusker & Belden Law , attorneys offering estate planning in Tracy, you’ll learn how trusts work and who can benefit from them. To find out which kind of trust is right for you, contact one of our lawyers. You can also arm your family and friends with the knowledge they need for estate planning by sharing this information with them.

-

An Overview of the Steps of Planning a Will

It’s all too common to delay creating a will until a serious illness strikes or an individual celebrates a milestone birthday. Many people delay consulting a lawyer regarding estate planning because they expect to lead a long, healthy life. While this is certainly ideal, a catastrophe can strike at any time. It’s advisable for all adults to work with Bakerink, McCusker & Belden a lawyer in Tracy to create a will. By establishing a last will and testament, you can protect your family’s future.

Evaluating Your Assets

Before you sit down with your lawyer to write your will, make a list of all of your assets. This list should include your bank accounts, real estate, retirement funds, life insurance policies, and various investments. It should also include personal assets such as your vehicle, art collections, jewelry, and other items of significant financial or sentimental value.

Designating Beneficiaries

Designating Beneficiaries Once you have a complete list of all of your assets, it’s time to decide who your beneficiaries will be . You can designate as few or as many beneficiaries as you wish. You may bequeath your liquid assets to your children, for example, and your real estate to your spouse. You may wish to divvy up family heirlooms among your beneficiaries. Bear in mind, however, that certain assets cannot be distributed with a will. This includes any property that you hold jointly. By law, this property will pass to the surviving owner. For example, if you own a house with your spouse, your spouse will automatically receive full ownership of the house upon your death.

Designating Legal Guardians

It’s widely known that wills are used to bequeath assets; however, many people overlook another important aspect of a will: Designating legal guardians. If you have children under the age of 18, you can use your will to designate a legal guardian upon your death. It’s common to designate a spouse as legal guardian and to designate another family member, such as a sibling, as the secondary guardian in the event that your spouse does not survive.

-

Tips for Leaving an Inheritance for Your Kids

When you’re ready to start thinking about your legacy to your children, it’s time to consult an estate planning lawyer . Your lawyer will draw up the documents for you and answer any questions you may have about estate planning in Tracy. For example, some parents automatically name the eldest child as the sole beneficiary of assets, after the death of a surviving spouse. They may assume that the eldest child will then fairly divide the assets among his or her siblings. However, to avoid confusion and ill will, it’s best to clearly state which child or other relative will receive which asset.

When you’re ready to start thinking about your legacy to your children, it’s time to consult an estate planning lawyer . Your lawyer will draw up the documents for you and answer any questions you may have about estate planning in Tracy. For example, some parents automatically name the eldest child as the sole beneficiary of assets, after the death of a surviving spouse. They may assume that the eldest child will then fairly divide the assets among his or her siblings. However, to avoid confusion and ill will, it’s best to clearly state which child or other relative will receive which asset.While handling matters of your estate, your lawyer may ask you if there are any stipulations involved with your kids’ inheritance. For example, it is possible to arrange for the inheritance to be distributed in installment payments when your kids reach certain ages. This can help prevent poor financial decision making. Estate planning lawyers often recommend these stipulations when children are known to have substance abuse issues or similar problems.

-

Why Estate Planning Is for Everyone

It’s a common misconception that only the wealthy or those with children should participate in estate planning in Tracy . In fact, every adult can benefit from working with an estate planning lawyer, regardless of income or marital status. Estate planning lets your survivors know what your final wishes are. You can designate beneficiaries for your assets by creating a will. You could also work with a lawyer to create a living will, or advance directive, which lets your loved ones know what your medical preferences are in the event that you become incapacitated.

For more information on estate planning, watch this video. This expert explains the basics of estate planning, such as setting up a revocable living trust, designating your beneficiaries for life insurance, and designating who will have power of attorney.

-

Essential Tips for Estate Planning

Estate planning is a complicated process. Consulting a lawyer regarding estate planning is the best strategy for ensuring that your beneficiaries are well taken care of and that your final wishes are carried out. Your lawyer in Tracy at Bakeirnk, McCusker & Belden can offer guidance regarding minimizing your heirs’ tax burden and ensuring that certain funds support your preferred purpose, among other estate planning strategies.

Consider Creating a Trust

You probably already know that you can be as specific as you wish in your will. You can choose to pass on your collection of vintage bottles to your favorite niece, for example, or to give your nephew your car. However, when you designate assets to beneficiaries in your will , you cannot control how your beneficiaries will choose to spend those assets. If you have particularly young beneficiaries who may not necessarily be given to making sound financial decisions, your lawyer may recommend that you create a trust. You can choose to create a trust with funds that are earmarked specifically for your child’s college expenses, for example. You can designate a trustee to administer these assets after your passing. Your trustee will be legally required to make sure that your assets are only used in the manner in which you intended.

Employ Tax Minimization Strategies

By consulting a lawyer with regard to estate planning, you can develop strategies to minimize the tax burden for your beneficiaries. Estate and income tax can significantly reduce the amount that your heirs will receive after your passing. You can ensure that they are taken care of by designating tax-free funds to your heirs and leaving taxable assets to charities, if you wish. An example of a tax-free account is a Roth retirement account.

Purchase Life Insurance

Another way to reduce your heirs’ income tax and estate tax burden is by purchasing life insurance. Life insurance is not taxable on the state or federal level. This means that your estate would receive the full amount of life insurance. If your lawyer estimates that your beneficiaries might be required to pay $300,000 in taxes, for example, you could purchase a life insurance policy for that full amount to eliminate their tax burden.

-

Why Is Estate Planning Important?

Estate planning is crucial for everyone, regardless of the extent of your assets and liabilities. By working with a lawyer in Tracy at Bakerink, McCusker & Belden, you can protect your estate for your heirs . If you die intestate, or without a valid will, your assets will be divided according to state laws, regardless of what your wishes may have been. If the court cannot determine who the proper heirs may be, the state can simply seize your assets, leaving your preferred beneficiaries with nothing.

You can hear more about the importance of estate planning by watching this video. This financial advisor discusses the benefits of working with an estate planning lawyer from a tax standpoint and explains some of the financial documents you should have in order.

-

Factors to Consider in Estate and Financial Planning

Many individuals delay estate planning in Tracy because it involves end-of-life issues. However, regardless of your age or health, it’s always in your family’s best interests to consult an estate planning lawyer sooner, rather than later. Unexpected tragedies occur all too often; by dealing with these matters promptly, you can ensure that your family’s financial future is protected in the event of your passing. When you meet with an attorney to address matters such as your last will and testament, you’ll need to consider the following factors.

Evaluate Your Financial Situation

Evaluate Your Financial Situation After scheduling a meeting with an estate planning lawyer, it’s time to gather together important financial documents. Review all of your financial information to determine the total value of your assets, and your current and anticipated cash flow. Compare your cash flow and assets to your total liabilities to determine your net worth. Consider other factors that may affect your finances in the future, such as the rising cost of living, your retirement or your spouse’s retirement, and unexpected, yet significant expenses, such as those related to a major illness. By understanding your particular financial situation, your estate planning lawyer can help you develop a sound financial plan for the future and for your heirs.

Consider Your Beneficiaries’ Needs

When you create a will with the help of your estate planning attorney, you’ll designate beneficiaries for your assets . You’ll also designate beneficiaries for your life insurance policy, retirement accounts, and similar accounts. It’s entirely your decision as to how to divide your estate among your family members, friends, or charitable organizations. However, when designating beneficiaries, you should consider their future needs and their spending habits. Many individuals earmark funds in a trust to cover specific expenditures, such as college tuition or special needs expenses.

Reduce Your Taxable Estate

Estate and income taxes can take a significant portion of the assets you allot to your beneficiaries. Your estate planning lawyer can help you develop efficient strategies to minimize tax obligations. You might also consider purchasing a life insurance policy that will cover the estate tax your heirs will owe.

-

What Is Trust Administration?

Trusts are often formed during estate planning . A trustee is designated to handle the assets within the trust. Trustees have a responsibility to protect the interests of the beneficiaries, safeguard the assets held within the trust, and administer the trust in a way that is consistent with the decedent’s final wishes. Trust administration is a highly complex process that must be performed in accordance with estate planning laws. It is highly recommended that designated trustees seek the counsel of a lawyer in Tracy at Bakerink, McCusker & Belden who can help them fulfill their duties.

A lawyer can help you identify the financial documents and other information you need to compile in the wake of the death. You’ll also need to stay in close contact with the executor of the individual’s estate because the executor may transfer non-trust assets to the trust. Your lawyer can help you locate the will and file it with your local probate court, make the necessary notifications of the death, and notify the beneficiaries. Then, you’ll need to complete an array of other tasks associated with trust administration, such as reviewing trust investments and paying off debts.

-

Common Questions About Estate Planning In California

Estate planning is a wise decision for all adults, no matter their age. Estate planning in California or elsewhere in the country involves designating your assets to beneficiaries, to be paid upon your passing. A lawyer in Tracy can help you with the estate planning process and answer any questions you may have.

Who Requires Estate Planning?

It’s a common misconception that an individual should only consult a lawyer about his or her estate if significant wealth is involved or if a serious medical diagnosis has recently been made. In fact, all adults should work with a lawyer to address these matters before there is an urgent need to do so.

What Does Estate Planning Involve?

What Does Estate Planning Involve? There are many facets to estate planning. Your attorney can draw up a last will and testament to specify which beneficiary should receive which of your assets. You can specify beneficiaries for any assets you have—ranging from life insurance benefits to retirement accounts to jewelry. Estate planning also involves designating who will handle matters after your death , such as paying your final debts and distributing the assets. With estate planning, you can make your final wishes known with regard to burial options. Additionally, your lawyer can walk you through the process of deciding who will care for minor children. Under California law, should you pass before all of your children have reached the age of 18, they are legally unable to care for themselves and manage their own property. You’ll need to appoint a guardian to do so. Your lawyer may recommend establishing a trust for minor children.

Who Should Be My Executor?

The executor of your will is an individual who is responsible for ensuring that your wishes are carried out and your assets distributed according to the will. Your executor should be organized, efficient, and capable of handling these matters. Many people designate their spouse to serve as executor.

Do I Need a Living Will?

Estate planning also involves creating a living will, or an advance directive. This is a legal document that specifies your wishes with regard to healthcare decisions in the event that you become incapacitated. For example, you may specify whether you wish resuscitation efforts to be made. With help from your attorney, you’ll designate a healthcare proxy to execute your living will.

““

-

Creating an Estate Planning Checklist

It’s important to make sure your loved ones are taken care of in case something happens to you. Careful estate planning can ensure that your wishes are carried out when you are unable to carry them out yourself.

In this video, an estate planning expert outlines a checklist of important actions to take while you are still of sound body and mind. First, it’s important to make sure your own health is taken care of—you can do this by signing an advance directive, or medical power of attorney. An advance directive outlines your specific healthcare wishes in the event of an accident or illness that leaves you incapacitated. Next, it’s important to have a financial power of attorney or living trust in place to ensure that your finances are properly distributed in the event of your death. A Tracy estate planning attorney can help with all these matters.

““

RECENT POSTS

categories

- Uncategorized

- Personal Injury

- Estate Planning

- customer reviews

- Financial Planning

- Work Injury

- Tracy Lawyer

- Attorney

- Dog Bites

- Auto Accident

- Slip and Fall

- Car Accident

- Living Trusts

- Trust Administration

- Living Will

- Wrongful Death

- Probate

- advanced health care directive

- About Us

- Russian linguist

- Infographic

- Wills and Trusts

- Will

- Car Crash

- Executor

- Whiplash Injuries

- Estate Taxes

- Slip and Fall Injury

- Auto Accident Claims

- Intestate Succession

- Disinheritance

- Trust Administrators

- Cycle Accident

- Accident